Does your customer think you are a strategic supplier?

INTRODUCTION

In the curious world of business, we find ourselves obsessed with categorisation.

Organising things, people, and organisations into boxes provides comfort, order, and the illusion of control. Suppliers, in particular, invest considerable energy in classifying their customers. Is this account "Strategic"? "Key"? "Basic"?

The goal, naturally, is to direct resources where returns and risks justify the investment.

But have you considered the mirror image of this exercise?

While you're busily categorising your customers, those very same customers are doing exactly the same to you.

Yes, you.

Their procurement teams are, at this very moment, analysing your business, your products, your services, and deciding whether you belong in their "strategic" box or their "irritating little cost" box.

Not quite so comfortable when the spotlight turns, is it?

The reality is both stark and unavoidable: procurement professionals classify suppliers with systematic precision. They must. Their business depends on it. And understanding how they view you determines not only your pricing power but your very future with that account.

The fundamental question then becomes not "How do I classify my customers?" but rather "How do my customers classify me—and how can I influence that classification?"

Kraljic's 4 boxes and why they matter.

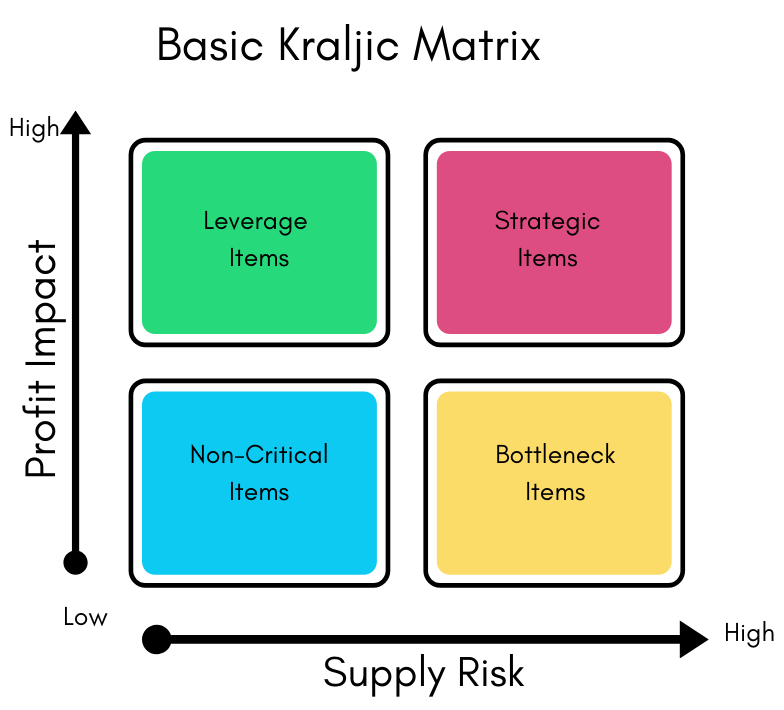

In 1983, Peter Kraljic published a framework in the Harvard Business Review that would transform procurement strategy forever. His matrix, elegantly simple yet profoundly impactful, categorises purchases based on two dimensions: supply risk and profit impact.

The resulting four-box matrix has become the procurement professional's bible. It sits on the desk of every buyer worth their salt. And it determines, with cold efficiency, exactly how they will treat you.

The four boxes are these:

Non-Critical Items:

Low profit impact, low supply risk. These are your everyday commodities, such as paperclips, standard services, items with abundant supply and minimal differentiation. The procurement strategy? Ruthless efficiency. Minimal attention. Standardised purchasing processes. Automated ordering. The relationship is transactional at best, non-existent at worst.

Leverage Items:

High profit impact, low supply risk. These purchases significantly affect the bottom line, but suppliers are plentiful. Think office furniture, standard raw materials, or IT hardware. The buyer's approach? Aggressive negotiation. Price squeezing. Supplier competition. Annual RFPs. The message is clear: "You're replaceable, and we'll remind you of it at every turn."

Bottleneck Items:

Low profit impact, high supply risk. These items don't cost much but could halt operations if unavailable, things such as specialized maintenance services or niche components. The buyer's focus? Securing supply. Mitigating risk. Perhaps developing alternatives or workarounds. The relationship is cautious, marked by contingency planning on the buyer's side.

Strategic Items:

High profit impact, high supply risk. These are critical purchases from limited sources, things like custom machinery, specialized consulting, or core raw materials. The buyer's approach? Partnership. Collaboration. Joint planning. Multiple-year horizons. This is the promised land for suppliers. It is where relationships transcend transactions.

Here's the uncomfortable truth: buyers want to place as few suppliers as possible in that "Strategic" box. Why? Because strategic relationships require investment, compromise, and mutual dependence. They introduce risk. They reduce flexibility. They demand resources.

Far easier to treat most suppliers as "Leverage" or "Non-Critical", thus maintaining the upper hand, to preserve optionality, to drive down costs through competition. The Kraljic Matrix provides the intellectual framework and organisational justification for exactly this approach.

The procurement professional's ideal world comprises a vast ocean of easily replaceable suppliers and a tiny island of genuinely strategic partners. Their career advancement often depends on expanding that ocean and shrinking that island.

Perhaps one of the most misunderstood aspects of Kraljic is that they assume the buyer places their company in a box..thinking "we are a strategic supplier, yes - we made it!" This is not the case. Buyers position categories, so you might have 2 product lines in classified as strategic, and the other 20 lines spread across the other 3 boxes.

Suppliers often misunderstand this aspect of Kraljic!

But as a supplier, your profitability, growth, and survival may depend on securing a spot on that strategic island.

And therein lies a dilemma.

Shifting boxes, changing perception.

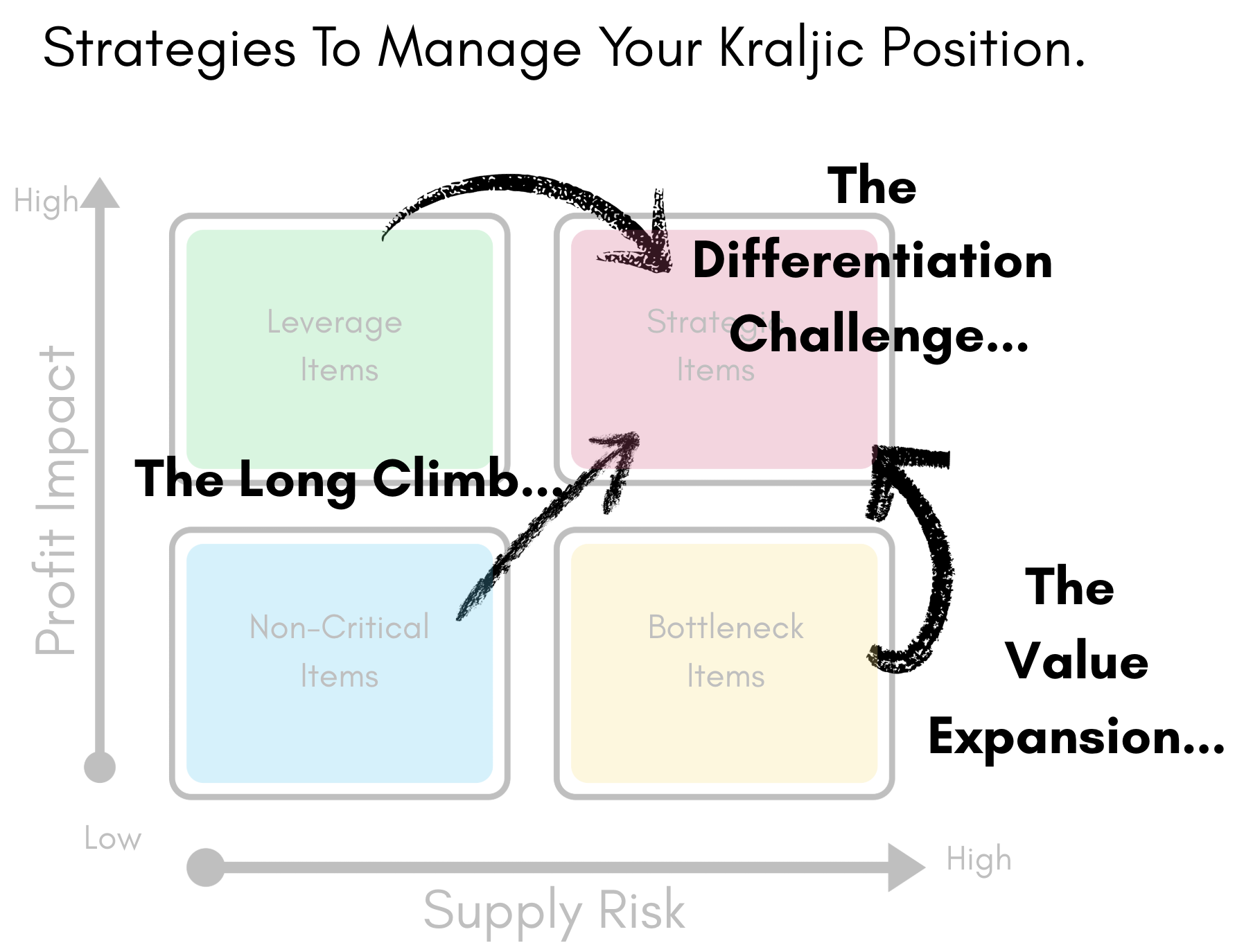

If we accept that buyers categorise us (which they do) and that their classification affects our business (which it does), then the central question becomes: How does a supplier shift from one box to another? More specifically, how does one move from the ocean to the island, shifting from "Non-Critical" or "Leverage" to "Strategic"?

The journey requires understanding, strategy, and patience. Let's explore the path for each starting position:

From Non-Critical to Strategic: The Long Climb.

If you find yourself in the "Non-Critical" quadrant, you face the steepest climb. You must increase both the buyer's perception of your profit impact and their perception of supply risk.

Step 1: Understand the Buyer's True Business Non-critical suppliers rarely see beyond their immediate contact. Break this pattern. Research the customer's business model, challenges, and strategic initiatives. Understand what truly drives profit for them, not just what your current offering touches.

Step 2: Find the Hidden Value Connection: Within that understanding, identify where your expertise (not just your current product or service) could significantly impact their profit drivers. Perhaps your seemingly mundane component could, with modification, improve their end product's performance. Possibly your service, if expanded, could eliminate a significant cost centre.

Step 3: Create the Risk Reality: This requires delicacy. You're not manufacturing false scarcity, but rather highlighting the genuine uniqueness of your approach. If you've developed a proprietary method, process, or technology that delivers unique value, ensure the buyer understands this differentiation. The goal is not to threaten supply disruption but to demonstrate that your specific approach cannot be easily replicated.

Step 4: Pilot the Transformation: Propose a limited test of your enhanced offering, just one targeted at a significant profit driver. Fund it yourself if necessary. Document results meticulously. Create a case study that demonstrates your strategic impact.

The non-critical to strategic journey is lengthy and is often measured in years rather than months. It requires investment, persistence, and a fundamental repositioning of your offering.

From Leverage to Strategic: The Differentiation Challenge

In the "Leverage" quadrant, you already have a profit impact. Your challenge is to increase the buyer's perception of supply risk so that you become less replaceable.

Step 1: Move Beyond Specifications: Leverage suppliers to compete within tightly defined specifications. Break free by engaging stakeholders beyond procurement. Understand the "why" behind the specifications and find opportunities to deliver the underlying need more effectively.

Step 2: Integrate, Don't Just Deliver, but develop ways to integrate your offering more deeply into the customer's operations. Can you connect to their systems? Can you assume responsibility for inventory management? Can you provide predictive analytics? The more embedded you become, the higher the switching costs.

Step 3: Lead with Insight: Leverage your industry knowledge to bring the customer insights they lack. Perhaps you see patterns across multiple customers that reveal emerging trends. Possibly, your technical expertise allows you to anticipate regulatory changes. Become the supplier who makes them more intelligent, not just the one who fills orders.

Step 4: Create Legitimate Scarcity: Again, this isn't about manufacturing false constraints. It's about developing truly unique capabilities that align precisely with this customer's needs. It might be a dedicated team that develops customer-specific expertise, customised equipment, or tailored analytics. Whatever form it takes, it must be difficult for competitors to replicate quickly.

The leverage to strategic shift often happens more quickly than the non-critical climb, but it requires careful navigation of organisational politics. You're asking the buyer to acknowledge increased dependency, which potentially contradicts the typical procurement mandate.

From Bottleneck to Strategic: The Value Expansion.

As a "Bottleneck" supplier, you have an unusual starting position. The buyer already perceives high supply risk, but doesn't see a significant profit impact. Your challenge is to demonstrate more excellent value from your specialised position.

Step 1: Understand the Cost of Disruption. Bottleneck items often have an impact that extends far beyond their direct cost. A small component might halt an entire production line if it is unavailable. A specialized service might be critical during specific events. Document and quantify these extended impacts to demonstrate the true profit connection.

Step 2: Expand Your Footprint From your secure position in one area, identify adjacent needs where your specialized knowledge offers an advantage. The customer already recognises your unique capabilities in one domain; demonstrate how those same capabilities can be applied to other challenges they face.

Step 3: Transform Risk into Opportunity. Bottleneck suppliers are often seen as necessary risks to manage. Change this perception by showing how your specialized capabilities can be utilised for competitive advantage. For instance, your unique component might enable product features that competitors cannot replicate. Additionally, your specialized service could open up new market opportunities.

Step 4: Become the Category Expert Position yourself not just as a supplier but as the leading authority in your niche. Publish thought leadership content. Participate in the development of industry standards. Host educational events. Establish yourself as the authority that influences how your category is understood and evaluated.

The bottleneck to a strategic shift necessitates reframing the narrative from risk mitigation to value creation. You're asking the buyer to envision possibilities where they previously saw only necessary dependence.

Already in the Stratrgic Box? Defend Your Position!

If you've reached strategic status, congratulations—but stay vigilant. Procurement's natural tendency is to reduce dependency and enhance competition. Your position is never guaranteed.

Continuous Innovation: Regularly introduce new capabilities and enhancements reinforcing your unique value.

Deep Integration: Create connections across multiple levels and functions within the customer organisation. The more touchpoints, the harder you are to replace.

Quantify Your Impact: Consistently document and communicate the specific value you deliver. Make your strategic contribution undeniable.

Anticipate Challenges: Proactively identify potential threats to your position from emerging competitors, technological shifts, and changing customer needs and address them before they become leverage points for procurement.

Know the box you are in - It's critical!

The Kraljic Matrix isn't just a procurement tool; it's the lens through which your business is evaluated. Understanding your current position, developing strategies to shift perception, and patiently executing those strategies isn't just good account management; it is commercial survival.

In a world obsessed with classification, the box you occupy dictates your future.

Manage your position carefully.

When you are ready, there are a few ways I can help.

1. DOWNLOAD MY LATEST ARTICLE:

If you want to find out more about Value-Based KAM and how it can become a significant competitive advantage to your business, click below and receive a copy of my latest article:

Rethinking Key Account Management: The 4 blocks to ignite KAM as your strategic competitive advantage.

If you would like a copy, please follow the link below

Click here for the Rethinking Key Account Management Article.

2. GET IN TOUCH TO DISCUSS COACHING OR TRAINING

Click on the link below, and we can start a discussion about your business needs and how a value-based approach might help you grow your sales.

I offer two streams of coaching:

- Key Account Management

- Offer Development & Innovation

I'd be pleased to have an initial conversation with you!

Click here to access the Value-Matters Coaching Options.

3. FOLLOW ME ON LINKED IN OR REQUEST TO CONNECT!

Click here to view Mark Davies's LinkedIn Page.

I try to post regularly on LinkedIn, providing additional insights into these Newsletters and articles. Follow me for regular updates.

Footnote

The insights, strategies, and opinions shared in this newsletter reflect the author's personal perspectives and experiences. While we strive to provide valuable and actionable information, please use your own judgment when implementing any recommendations. Results may vary based on your specific circumstances, market conditions, and implementation approach. The author and publisher accept no liability for decisions made based on this content. You're the expert in your business, we're just here to spark ideas!

© Value-Matters.net. All rights reserved. Sharing with colleagues is encouraged, but please give credit where it's due. Questions? Reach out to [email protected].

Responses