What is the kingpin of any customer management strategy?

How to segment your customer portfolio

INTRODUCTION

Here is a question that keeps commercial leaders awake at night: Why do some customer relationships flourish while others quietly drain resources and deliver diminishing returns?

The answer, more often than not, lies in a fundamental mistake.

Most organisations segment their customer portfolio using a single metric: last year's sales. It seems logical. It feels objective. And it is dangerously incomplete.

When you segment solely on historical revenue, you are making decisions with the wrong analysis. You end up over-serving customers who do not justify additional support, while under-serving those with strategic importance and genuine growth potential. You allocate your best people to accounts that look impressive on a spreadsheet but offer little future value. Meanwhile, tomorrow's most important partnerships receive yesterday's approach.

This is not a minor operational issue. Customer segmentation sits at the heart of any serious customer management strategy. Get it wrong, and everything downstream suffers: your resource allocation, your account planning, your value propositions, and ultimately your competitive position.

The good news? There is a better way. A methodology that has been applied successfully across industries, from professional services to pharmaceuticals, from technology to industrial manufacturing. It requires more thought than a simple revenue sort. But the clarity it provides transforms how organisations compete.

Let me show you how it works.

What is customer segmentation?

At its simplest, customer segmentation is the process of dividing your customer portfolio into distinct groups that require different approaches, different levels of investment, and different commercial strategies.

Think of it as creating a map of your customer landscape. Without a map, every customer looks roughly the same. You treat them with similar intensity, similar resources, and similar expectations. With a proper segmentation model, you suddenly see the terrain clearly. You understand where to invest heavily, where to maintain efficient service, and where the hidden opportunities lie.

Organisations can supply portfolios of many thousands of customers. These customers have differing requirements from you. But here is the crucial insight: you also have differing commercial aspirations from each of them.

Customers are not all created equal. Some are smaller consumers, some are larger. Some have proven track records and years of trading history. Others show signals of great potential that remains untapped. Some align perfectly with your strategic direction. Others, frankly, do not.

A robust segmentation model acknowledges these differences and builds a framework for responding to them intelligently. It answers three fundamental questions:

- Which customers deserve our greatest attention and investment?

- Which customers should receive efficient, standardised service?

- Which customers have the potential to become strategically important, even if they are not there yet?

Without clear answers to these questions, resource allocation becomes political rather than strategic. Account managers fight for support based on relationships rather than opportunity. And the organisation lurches from quarter to quarter without a coherent view of where value will come from.

Why segment (and what happens when you miss this critical step?)

Let me be direct about the stakes here.

Organisations get into serious trouble when they over-serve customers who cannot provide a good return, and under-serve those who can. This is not a theoretical risk. It happens in every organisation that relies on simplistic segmentation approaches.

Consider what poor segmentation actually costs you:

Wasted resources on low-potential accounts. Your most experienced account managers spend their time nurturing relationships with customers who will never grow significantly. They deliver exceptional service to accounts that would be satisfied with far less. Every hour invested here is an hour not invested in genuine opportunities.

Neglected relationships with high-potential customers. While your team focuses on familiar, comfortable accounts, competitors are building relationships with the customers who could transform your business. These high-potential accounts receive generic treatment. They never see your best thinking or your most compelling value propositions. And one day, you discover they have chosen a competitor who paid attention.

Misaligned value propositions. When you treat all customers similarly, you cannot tailor your approach to what each genuinely needs. Key accounts require bespoke solutions built around their specific challenges. Foundation accounts need efficient, reliable service without unnecessary complexity. Confuse these approaches, and you either overwhelm smaller customers with unwanted sophistication or underwhelm strategic accounts with generic offerings.

Reactive rather than strategic planning. Without proper segmentation, your customer strategy becomes a collection of individual account plans with no coherent framework. You cannot see patterns across your portfolio. You cannot anticipate where growth will come from. You cannot make intelligent decisions about capability investment.

Here is what effective segmentation provides instead:

Clarity on where to compete. You know which customers justify significant investment and which require efficient management. This is not about caring less about certain customers. It is about matching your approach to the opportunity.

Aligned resources. Your best people work on your most important accounts. Your systems and processes support efficient delivery to your broader customer base. Everyone understands why resources flow where they do.

Future-focused planning. You identify high-potential customers before they become high-revenue customers. You build relationships and prove value early, before competitors recognise the opportunity.

Honest conversations. When your segmentation model is transparent and well-understood, account managers know what is expected.

Leadership can have informed discussions about customer strategy rather than debates driven by opinion and politics.

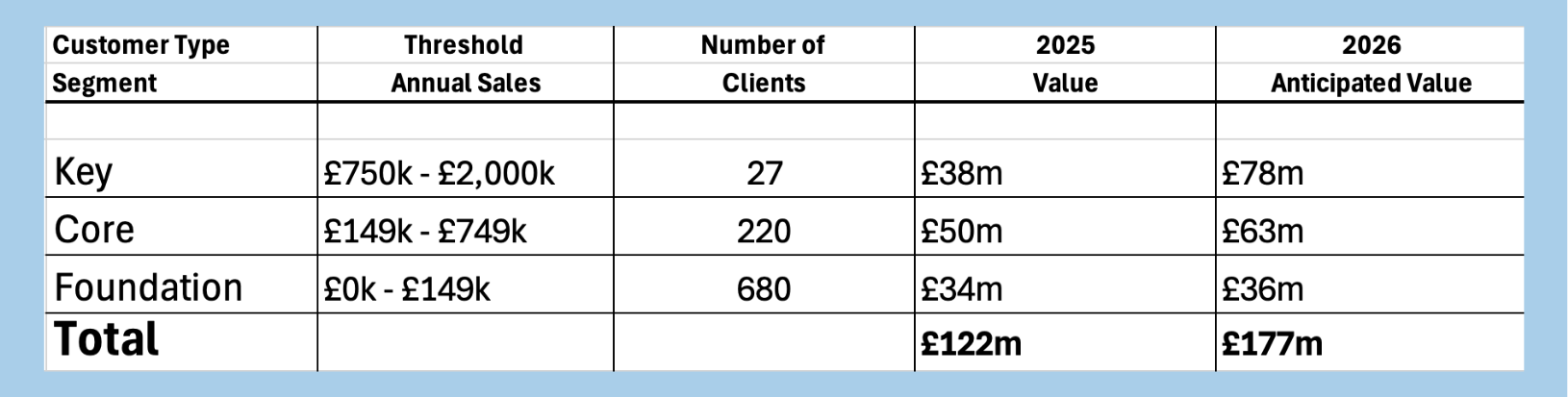

This consulting practice example in the table below illustrates this beautifully. When they conducted their primary segmentation, they discovered a striking pattern:

Look at those numbers carefully. The 27 key customers represented £38 million in 2025 but were projected to deliver £78 million by 2026. That is a doubling of value from just 3% of their customer base. Meanwhile, their 680 foundation customers were projected to grow from £34 million to just £36 million.

NOTE - The growth in Key and Core customers was based on accelerated performance following our Value-Based KAM training and coaching.

This analysis transformed how they thought about resource allocation. It revealed that their future growth depended heavily on how well they managed a small number of key relationships. It showed where investment would generate returns and where efficient service was the appropriate strategy.

Without this segmentation exercise, they would have continued spreading resources across their portfolio without understanding where value creation would actually occur.

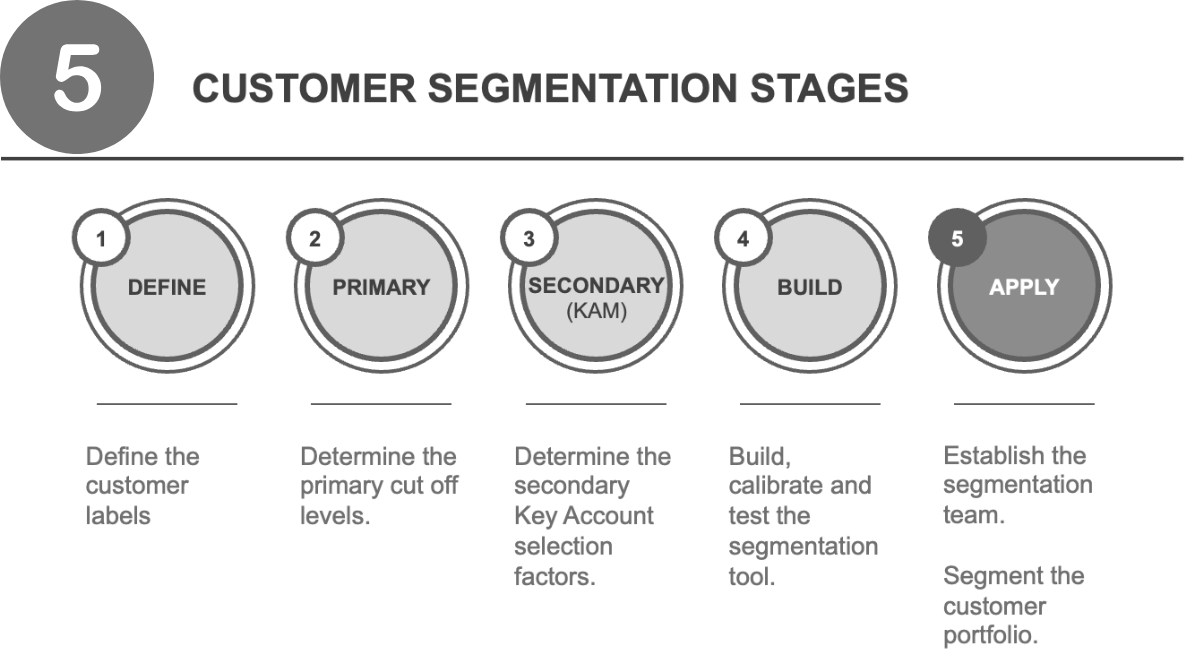

5 steps to segment a customer portfolio

Effective segmentation requires a structured approach. I have applied the following methodology across many organisations in many industries. It works because it balances rigour with practicality and involves the right people in the right decisions.

Stage 1: Define

Before you can segment customers, you need to establish what your segments will be called and what they mean. This sounds obvious, but many organisations skip this step and create confusion that persists for years.

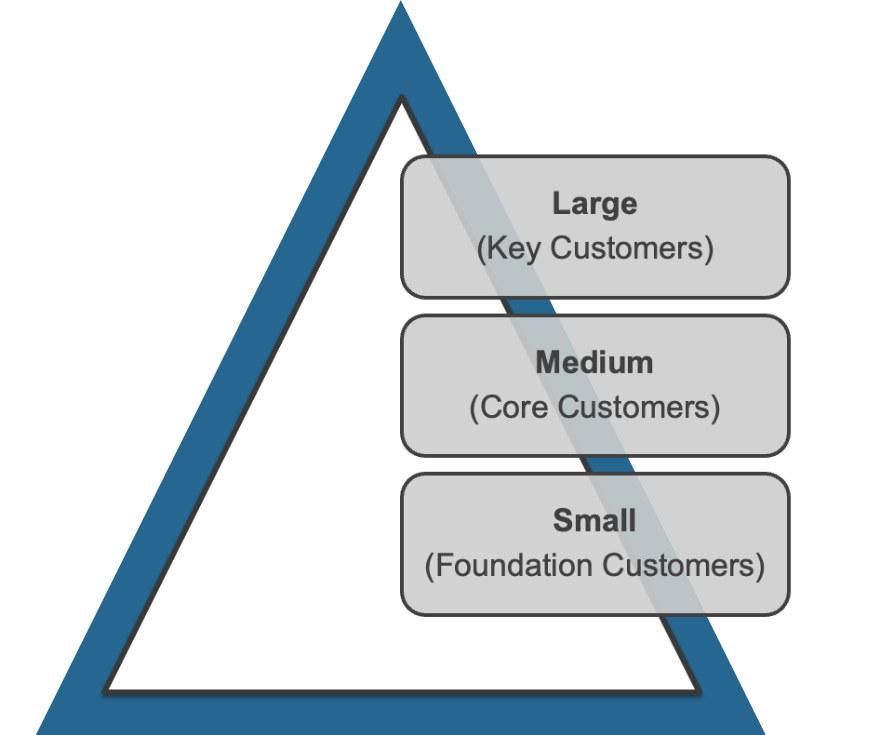

The model I recommend uses three primary tiers: Foundation, Core, and Key.

Foundation customers tend to be smaller by opportunity and have limited scope for future growth. There is typically a larger number of customers in this tier. They require efficient, standardised service rather than significant customisation.

Core customers are slightly larger and require a more focused approach from account management teams. They comprise a smaller group but offer greater opportunity per customer than foundation accounts.

Key customers are a smaller group but represent very high value. They are more complex to manage, but the potential rewards are significant. Critically, if you lose a key customer, it can severely damage overall business performance.

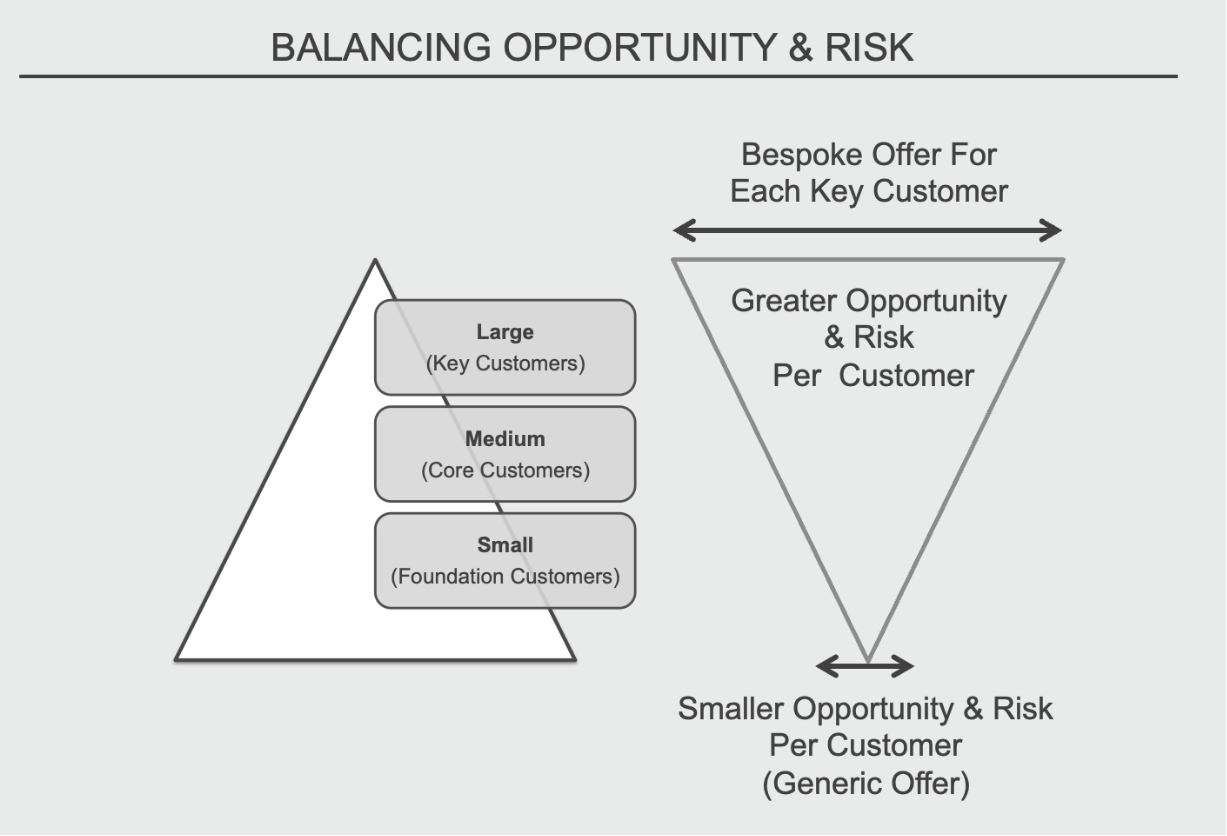

The diagram below shows the primary customer segmentation model as a pyramid, with key customers at the top, core in the middle, and foundation at the base.

The next diagram illustrates an important principle: as you move up the pyramid, both opportunity and risk increase per customer. Key customers require bespoke offers tailored to their specific needs. Foundation customers can be managed effectively with a more generic approach.

Stage 2: Primary Segmentation

The primary cut is usually defined by financial values, typically annual sales. This provides an initial filtering and positioning of your customer portfolio.

However, and this is crucial, you must also identify high-potential customers that currently fall into the foundation or core segments. Just because a customer provides low or even zero sales today does not mean they will not be key in the future.

Build a system to tag these "HiPo" (high-potential) customers so they receive appropriate attention despite their current revenue position.

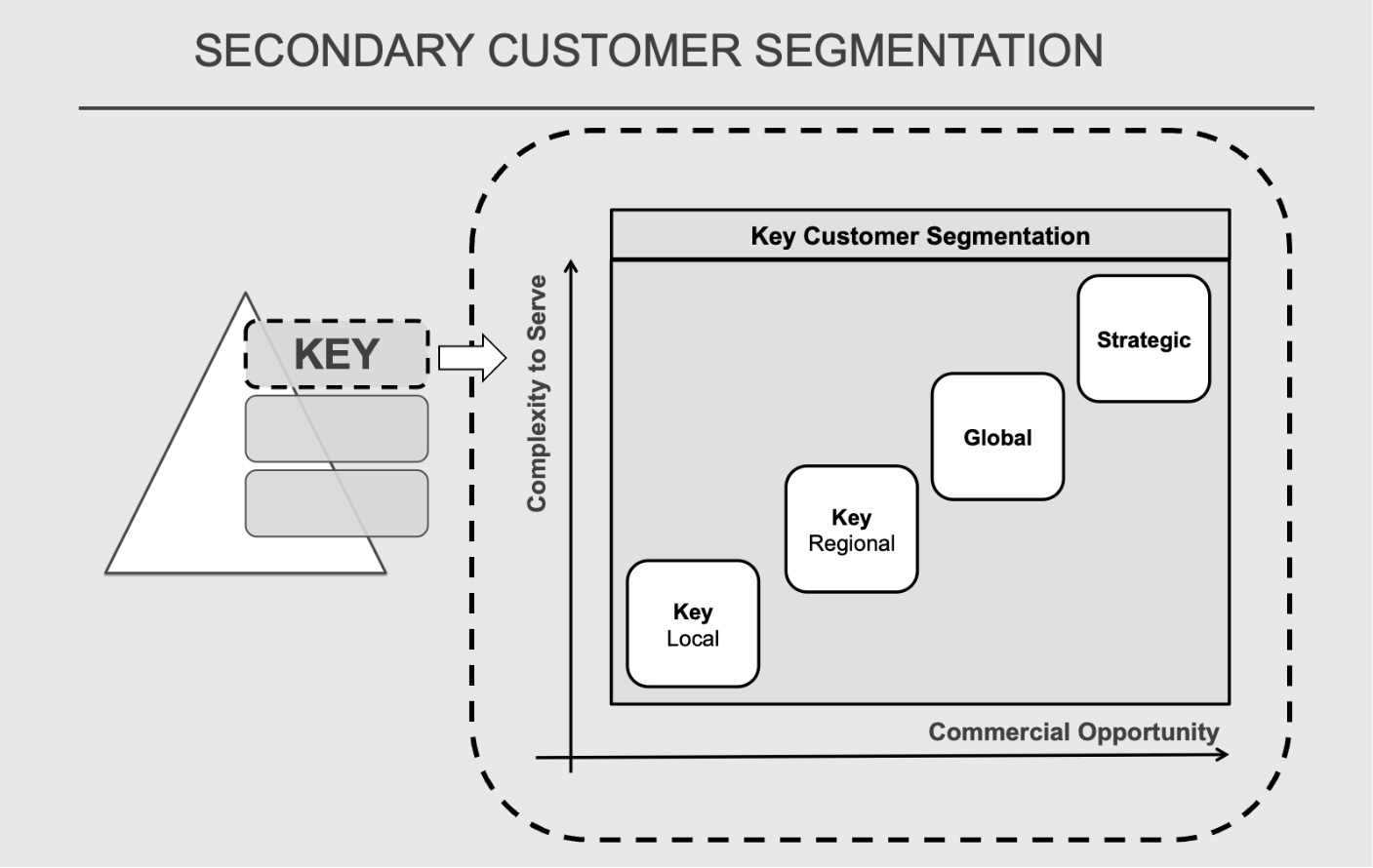

Stage 3: Secondary (KAM) Segmentation

This is where the methodology becomes more sophisticated. The label "key" is very wide and covers a range of different customer types with different opportunities and different management challenges.

The above diagram shows how key customers can be further classified into four sub-types:

- Key (Local): Key account customers that reside in a local area or country.

- Key (Regional): Key account customers with operations across several countries within a region. They require a different management approach as expectations shift between countries.

- Key (Global): Large-scale customers requiring service across two or more regions. Think US, Europe, and Asia simultaneously.

- Key (Strategic): Customers who take products and services from multiple supplier business divisions. The coordination across these business silos requires increased effort, but alignment can prove very beneficial by leveraging business between different business units.

Your business may not need all four classifications. Some organisations operate within only one country, which negates the need for regional or global types. The critical point is to acknowledge that not all key account customers are the same, and your organisation needs to manage different classes appropriately.

Beyond the geographic classification, you should assess each key customer relationship using a simple but powerful framework. Ask two questions:

- How important is the customer to you?

- How important are you to the customer?

maps these questions into four relationship types:

Partnership KAM: The customer is important to you, and you are important to them. These relationships are balanced, mutually beneficial, and both parties consider it worthwhile investing time and effort. Expect open, transparent discussions about how to work together.

Transaction KAM: The customer is less important to you, and you are less important to them. Business relationships are necessary but focus on commodity factors: price and adherence to specification. Investment should be minimal, just enough to get the job done.

Association KAM: The customer is less important to you, but you are more important to them. These relationships need careful management. Customers who really like your offering but lack growth potential can consume resources if not controlled. Manage carefully, as circumstances may change.

Trust-Building KAM: The customer is important to you, but you are less important to them. For various reasons, they view you as a smaller player. This could reflect lack of trading history, scale, location, or simply lack of appreciation for what you could provide. If the customer has genuine potential, you need to build the relationship and establish trust. This takes commitment, but these could become your partnerships of the future.

Stage 4: Build

When your attractiveness factors are established, build your segmentation model. This is usually captured in a spreadsheet that holds all data and decisions.

Apply weightings to reflect what matters most to your business. For instance, growth opportunities might be weighted at 60%, with relationship history and number of operations each at 20%.

Calibrate the model by populating it with a small group of customers you know well. Test whether they fall into the expected categories. Adjust as needed.

Crucially, form a KAM selection panel. This group of representatives from across the organisation (commercial, technical, supply chain, and business leadership) will meet to consider each customer's merit. Individual expertise should provide non-biased but informed knowledge about each customer and realistic ideas regarding potential and effort to manage.

Stage 5: Apply

Conducting primary segmentation is relatively straightforward once threshold levels are set. A spreadsheet can identify which customers fall into each band.

The secondary segmentation panel should meet over several sessions to assess each customer for KAM status. Do not overwhelm the panel with huge numbers; typically thirty to seventy customers should be reviewed and scored using the secondary selection criteria.

One final note deserves emphasis:

Building a segmentation model provides a framework for better-informed decisions about how to manage and resource customers. While a spreadsheet tool with weightings and descriptions is essential, it should always be seen as part of a process that helps the business decide how to position and manage customers.

It is the leaders of the business who decide how to manage customers, not a spreadsheet model.

Summary

Customer segmentation is not an administrative exercise. It is a strategic capability that determines whether your organisation competes on value or stumbles into commodity battles you cannot win.

The methodology outlined here provides a practical, tested approach:

- Define your segment labels and what they mean

- Conduct primary segmentation using financial thresholds while identifying high-potential customers

- Apply secondary segmentation to classify key customers by type and relationship

- Build a tool with appropriate weightings and form a selection panel

- Apply the model through structured panel discussions

When done well, segmentation transforms how your organisation thinks about customers. It moves you from reactive account management to strategic customer development. It ensures your best resources work on your best opportunities. And it creates a shared language for discussing customer strategy across your business.

The alternative (relying on last year's sales as your primary guide) guarantees that you will continue over-serving customers who do not justify it and under-serving those who could transform your business.

The choice is yours.

Self-Diagnostic: How Effective is Your Customer Segmentation?

Score each statement from 1 (strongly disagree) to 5 (strongly agree):

- We have clearly defined customer segments with documented criteria for each tier.

- Our segmentation considers future potential, not just historical revenue.

- We have a formal process for identifying high-potential customers in lower segments.

- Our key accounts are further classified by type (local, regional, global, strategic).

- We assess the mutual importance of each key customer relationship.

- Our segmentation model informs resource allocation decisions.

- We have a cross-functional panel that reviews and validates customer classifications.

- Our segmentation model is reviewed and updated at least annually.

- Account managers understand and accept the segmentation criteria.

- Leadership uses segmentation insights when making strategic decisions.

Scoring:

- 40-50: Your segmentation practice is mature. Focus on refinement and ensuring consistent application.

- 25-39: You have foundations in place, but gaps remain. Prioritise the areas where you scored lowest.

- Below 25: Segmentation is a significant opportunity for improvement. Consider a structured approach to building this capability.

Ready to Transform Your Customer Segmentation?

In March 2026, Value Matters is launching the Value-Based KAM Programme, a cohort-based training experience that combines proven Key Account Management methodology with practical AI integration. This will be developed and delivered with my colleague (and AI expert) Richard Brooks.

The programme covers customer segmentation, alongside value proposition development, account planning, and the full Value-Based KAM Framework.

If you recognise that your current approach to customer segmentation is costing you opportunities, I would welcome a conversation.

Contact me directly to discuss whether this programme is right for your organisation.

Mark Davies is the Founder of Value-Matters and author of "Infinite Value" (Bloomsbury, 2016). He has over 20 years of experience helping B2B organisations build competitive advantage through value-based Key Account Management.

Responses