Building a competitive advantage with channel partners.

INTRODUCTION

Welcome back to The Value Matters Newsletter. In our previous editions, we've explored how to craft a one-page customer management strategy, segment your customer portfolio, and master direct key account management. In this newsletter, we tackle the most overlooked aspect of customer management: how to turn your distribution channels from value destroyers into competitive weapons.

The £20 Million Question Nobody Asked

Picture this: You're an engineering director about to invest millions in a state-of-the-art pharmaceutical facility. The centrepiece?

A Building Energy Management System (BEMS) that will literally control the brain of your operation. Get it wrong, and the FDA could shut you down before you manufacture a single pill.

This was my reality in 1995. What followed was a masterclass in how supply chains can either create tremendous value or destroy it entirely. The lessons learned over that 20-year journey? Seeing the same story unfold from three different perspectives. This story fundamentally changed how I think about channel management.

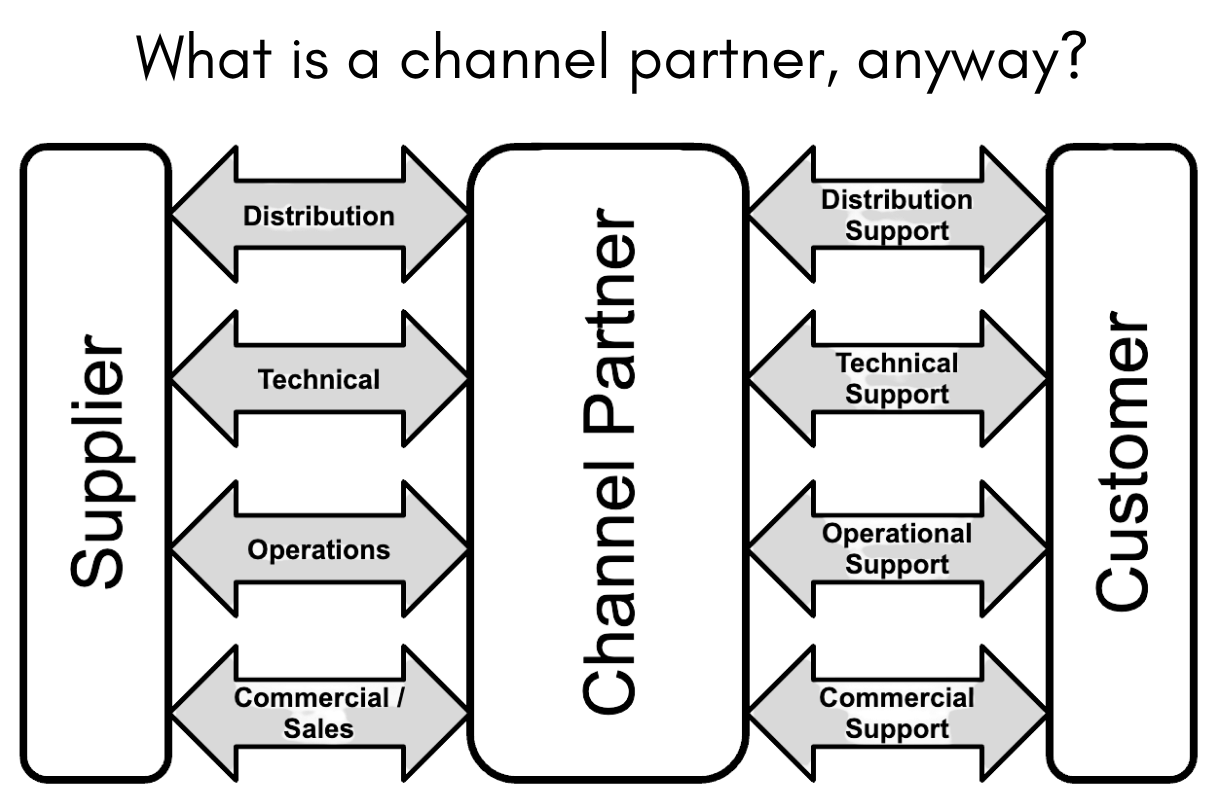

Here's the uncomfortable truth: Most organisations serve 20-60% of their customers through third-party channels. Some rely on channels for 100% of their business. Yet, how many have a systematic approach to channel partner management? How many treat their channel partners as customers rather than mere distribution points?

The answer, in my experience working with hundreds of organisations, is shockingly few.

The BEMS Story: When channels destroy value.

Here's my story.

I watched a supply chain systematically destroy value while everyone involved thought they were doing their job perfectly.

Act I: The End-User Perspective

As engineering director, I needed a BEMS that would pass a rigorous FDA validation. Essentially, the difference between a successful £20 million facility and a costly monument to failure. The selection process seemed straightforward until I discovered the reality of modern supply chains.

Between me (the end-user) and the BEMS manufacturer sat three organisations: the Design & Build Contractor, the Mechanical & Electrical Contractor, and the Panel Builders. Each one was contracted by the one above, each focused on their immediate customer, and none thinking beyond their contractual obligations.

The result? I had to fight my way through three layers of intermediaries just to influence the selection of equipment that was critical to my operation. For 80% of the facility, this was fine. I was happy to let contractors manage "commodity" items, such as walls and drains.

But for the BEMS? This was mission-critical, and the supply chain structure was actively working against MY value creation.

Act II: The Channel Partner Reality

Fast-forward 15 years. I'm now a consultant, commissioned by the same BEMS manufacturer to understand their supply chain. I interviewed six panel builders and two contractors. These were all highly professional, successful organisations.

My conclusion was both startling and predictable: Nobody within the supply chain was thinking or acting beyond the organisation they were directly contracted to serve.

Think about that for a moment. The BEMS supplier was developing a sophisticated, high-quality product that could deliver tremendous value to end-users. But that value was being systematically eroded because each layer of the supply chain operated on a simple principle: reduce costs for the immediate customer.

The panel builders wanted cheaper products from the BEMS supplier.

The M&E contractors wanted cheaper installations from the panel builders.

The Design & Build contractors wanted cheaper everything from everyone.

Value was being "stifled by the supply chain" because it operated as a cost-saving process for short-term building contracts, rather than as a value-creation engine for long-term (25-year) customer operations.

Act III: The Supplier's Dilemma

Here's where it gets really interesting.

When I discussed my findings with the BEMS supplier's senior sales director, he told me something that should terrify every supplier reading this: the way I had behaved as an end-user customer, i.e. actually getting involved in supplier selection and working across the supply chain, was "very unusual, in fact it seldom happened."

Worse still, end-users were increasingly outsourcing facility operations to management companies. Not only was the construction and specification of equipment severed between supplier and end-user, but the lifelong operation (where real value could be realised) was also fractured.

The supplier was trapped.

They were developing long-term, high-quality products but could never fully realise their value because the supply chain was optimised for short-term cost reduction, not long-term value creation.

The Value Equation: Why Channels Matter

Before we dive into solutions, let's establish why this matters. Warren Buffett said it best: "Price is what you pay, value is what you get." Yet most channel conversations focus obsessively on the former while ignoring the latter.

Value, properly understood, equals Impact minus Total Cost of Ownership. Value Impact comes from five sources:

- Top line: Helping customers grow sales and revenue

- Bottom line: Reducing operational and fixed costs

- Business reputation and continuity: Managing risk, safety, quality, and compliance

- Strategy, organisational and advisory: Navigating change and competition

- Meeting consumer needs: Understanding the end customer's ultimate requirements

In my BEMS story, the value impact was enormous. A £100,000 system failure could delay a £20 million project by months, halt the site's ability to generate profits, and potentially breach supply contracts.

This equated to a multi-million-pound exposure. Yet, nobody in the supply chain discussed business reputation, continuity, risk, or protecting my brand with me.

The discussions primarily focused on fees and contracts. The value opportunity was infinite, but the supply chain had reduced it to finite cost negotiations.

The Channel Tension:

Corporate vs. Entrepreneurial

Here lies the fundamental challenge. As a larger organisation extending your reach through channels, you need cost-effective distribution, brand extension, and rapid market access.

Your channel partners, often entrepreneurial SMEs, need brands and valuable products to make money, plus commercial and technical support.

This creates what I call "The Channel Tension.

You're thinking corporately about market coverage and brand consistency. BUT

They're thinking entrepreneurially about profit margins and growth opportunities.

The question each organisation must answer is deceptively simple but strategically critical: "What are you to each other, exactly?"

This is something I describe as "Value Celling" - taking a helicopter view of the supply chain and examining each "cell" (organisation) to understand what motivates them to run their own business.

No company tries to destroy value. They want to prosper and win "the game" that they are playing.

Are they customers? Suppliers? Competitors? Partners?

Most organisations struggle to answer this clearly, which explains why many channel relationships underperform.

Ten Steps to Build Supply Chain Capability

Based on my research and consulting experience, here's a systematic approach to transforming your channels from value destroyers into competitive advantages:

Strategy Phase:

Step 1: Understand What You Need. Ask yourself the hard questions: What end-customers must we access? Where are they located? Do we have the commercial, technical, operational, and logistical reach to serve them directly? What behaviour do we need from channel partners, and are we getting it today?

Step 2: Segment and Classify. Develop a segmentation model that classifies channel partners by their impact on reaching target customers and their intent to work in partnership. Not all channel partners are created equal. Your strategic approach should reflect this reality.

Develop Phase:

Step 3: Start a Dialogue. The keyword is "partnership." Building a common strategy and understanding requires genuine, open conversations. You should choose them because they seem to fit your needs, but there must be mutual value. If a channel partner doesn't see value in collaboration, reconsider whether they should be a strategic partner.

Step 4: Agree on Partnerships. Formalise the relationship through service-level agreements and potentially legal contracts. However, try to lean towards partnership rather than purely formal arrangements.

Step 5: Select Your Team. Channel management requires specific competencies. Build your organisation around channel types. For example, strategic partners need dedicated focus. One full-time equivalent can manage two strategic partners or ten associate partners.

Step 6: Develop Value Models. Develop capability standards that enable channel partners to transition to value-centric business models. Ask yourself: "If I were running this channel business, what would I need to develop the required new ways of working?"

Operate Phase:

Step 7: Train, Coach and Develop. Implement value-based principles through training modules, online learning, planning tools, facilitated workshops, and leadership coaching. If you don't share your knowledge about value-based business, how else will they learn?

Step 8: Build Joint Strategies. Could you collaborate with channel partners to gain a deeper understanding of the customers they serve, particularly your key target accounts? Joint planning across commercial, technical, operational, and supply chain aspects leads to stronger results for everyone.

Step 9: Share Best Practice. Create channel partner alumni organisations. Set up clubs where partners can attend conferences, listen to webinars, and share success stories. These become prized memberships and motivational drivers.

Step 10: Reflect that Markets change, and initial thinking isn't always perfect. Constantly review your strategy, segmentation, partner selection, and results. Be prepared to repeat the cycle.

Ten Tips to Create Value with Your Supply Chain

Now for the tactical advice that can transform your channel relationships:

Have a 'Value Cell' Philosophy. Your supply chain can be a source of competitive advantage, but only if it is developed strategically. Don't just sit back and assume your products alone will drive growth.

When competitors match your offerings, a well-developed supply chain becomes your differentiator.

2. Map Your Supply Chain: Create a visual representation of all key players, including suppliers and competitors. It may look complex, but you need to understand the battlefield you're operating in. Model what's happening at each stage and identify where value is being created or destroyed.

3. Put Yourself in Their Shoes. When supply chains fragment and organisations work in isolation, take time to understand their perspective. Speak to managers in each organisation to know why they make the commercial decisions they do. You might be surprised by what you learn.

4. Describe the Value Proposition Between Each Party.

Model what each organisation's value proposition is to their direct customer. Do they talk about value correctly, or do they offer "cheaper alternatives"? Understanding these dynamics reveals why your supply chain behaves as it does.

5. Ask the Supply Chain What They Think of You. Take a collegiate stance and ask for feedback. Are you a good supplier? Do they get effective technical, commercial, and market advice? What can you do to help them increase their earnings?

6. Preach Value. Many channel partners are smaller, entrepreneurial organisations that may never have considered what value means. Discussing value and offering training sessions is often genuinely appreciated. Be obsessed with and constantly talk about value.

7. Hold Value Seminars. Organise regular conferences and workshops. Make them two-way discussions where channel partners present their value creation examples. Manage competition law considerations carefully, but the benefits are significant.

8. Change the Conversation. To discuss big value opportunities, talk to increasingly senior people. Target 10-20 senior executives across your supply chain. It requires brave, open, reciprocating conversations, but the information gathered is incredibly powerful.

9. Look Backwards. Be "value-centric" rather than just "customer-centric." Help everybody in your supply chain, especially your suppliers. How hypocritical would it be to demand value-based treatment while not providing it yourself?

10. Value Co-Create Organisations often seek new partners or competitors to collaborate with while ignoring the willing, capable partners they already work with: their supply chain. View your channels as a source of significant competitive advantage through end-to-end value creation.

The Uncomfortable Truth About Channel Management

Here's what most organisations don't want to admit: they've created channel strategies that prioritise their convenience over customer value. They select partners based on coverage and cost, then wonder why those partners don't deliver strategic value.

The BEMS story illustrates this perfectly. The OEM supplier had developed superior technology that could deliver tremendous value to end-users. However, they had no systematic way to ensure that value reached the customer, as they treated their supply chain as a necessary evil rather than a competitive advantage.

The result? A £100,000 system that could prevent millions in losses was sold primarily on price because nobody in the channel understood or communicated its actual "absolute" value.

Your Channel Strategy Reality Check

Ask yourself these uncomfortable questions:

- What percentage of your business flows through third parties?

- How many of your channel partners could articulate your value proposition to end customers?

- When did you last have a strategic conversation with your top channel partners?

- Do your channel partners see you as a supplier, customer, competitor, or partner?

- What training have you provided on value-based selling?

If you're struggling to answer these questions confidently, you're not alone. But you're also sitting on one of the most significant opportunities in your business.

The Path Forward

The organisations that will dominate their markets in the coming years won't just have great products. They will also have great channel partners who understand, communicate, and deliver value at every touch point.

This requires a fundamental shift in thinking.

Stop seeing channel partners as distribution points and start seeing them as customer-facing extensions of your value proposition. Invest in their success as heavily as you invest in your direct customer relationships.

The BEMS story ended successfully because an end-user customer (me) fought through the supply chain to ensure the delivery of value. But imagine if that hadn't been necessary. Imagine if every layer of the supply chain had understood the actual value at stake and worked collaboratively to deliver it.

That's not just a nice-to-have.

It is your competitive advantage waiting to be unleashed.

Responses