Who is the customer, anyway?

All customers are important (but some are more important than others)

INTRODUCTION

Continuing the 5-stage model described in the last two Newsletters to develop a Customer Management competitive advantage, we now look at the second stage: customer segmentation. This is perhaps the keystone of any customer management strategy and, consequently, critical for any organic growth initiative.

It is often completely overlooked and poorly executed.

To explain, this is a story (based on a real-life consulting assignment)

The characters and business are fictional. The scenario is prevalent!

The tale of Ballantyne Instruments

The silent hum of Ballantyne Instruments, a £150 million beacon of precision metrology, usually filled Alan Higgins, Global Head of Business Development, with a quiet pride.

Their ultra-high precision measurement systems, vital across aerospace, automotive, medical devices, and consumer electronics, ensured microscopic accuracy and streamlined production. Ballantyne's global clients valued their R&D and customer focus.

Yet, Alan's ambition of 15% growth in two years felt distant. Sales were flatlining, even declining. The pressure on Alan was immense.

In desperation, Alan enlisted David Johnson, a customer management consultant recommended by a colleague whose company had seen a dramatic 30% growth.

Their first meeting began without preamble.

The conversation.

"How can I help?" David inquired.

"Sales are down, and I'm under intense pressure to grow!" Alan declared.

He laid out market opportunities: the global push towards Industry 4.0, the rise of additive manufacturing, burgeoning emerging markets, and the potential of customization all promised significant demand.

Yet, formidable threats loomed: fierce global competition, the relentless pace of technological obsolescence demanding constant R&D, a pervasive skilled labor shortage, and the inherent vulnerabilities of their supply chain.

"Understood," David responded, his gaze steady. "Now, tell me, who exactly are your customers, and how did you select them?"

Alan fumbled with his words.

Customers were served through distributors, he explained, and as he spoke, it became painfully clear that he lacked a precise understanding of their customer base. The business, he admitted, tracked sales by product line, not by individual customers.

"So, there's no formal customer segmentation process?" David pressed, a slight arch to his eyebrow. "Do you know who your key customers are, and how to treat them distinctly?

And conversely, do you know where to relax your efforts with smaller opportunity customers?"

"Er... no," Alan confessed, the admission hanging in the air. "How do I do that?"

Without a word, David seized a blank sheet of paper, and began sketching, his pen moving with purpose. "It all starts," David began, "with understanding the customer portfolio through segmentation."

The customer segmentation process

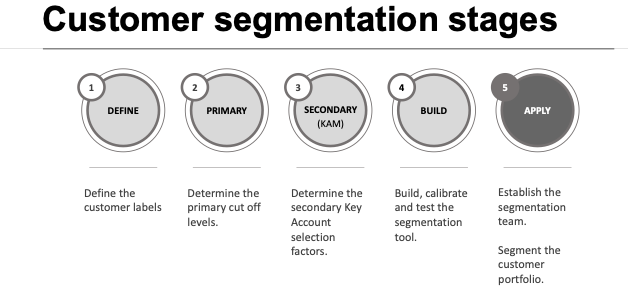

"The process is methodical, Alan," David explained, gesturing to his sketch. "First, 'Define'.

We need to define the customer labels – essentially, what categories make sense for your business?

Then, 'Primary'. Here, we determine the primary cut-off levels for those categories. Think of it as an initial filter.

Next, 'Secondary', which often involves Key Account Management. This is where we determine the secondary key account selection factors, drilling deeper into who truly drives your business.

After that, we 'Build'

We build, calibrate, and test the segmentation tool itself.

Finally, we 'Apply'. We establish a dedicated segmentation team and then segment the entire customer portfolio.

It's a structured approach to bring clarity."

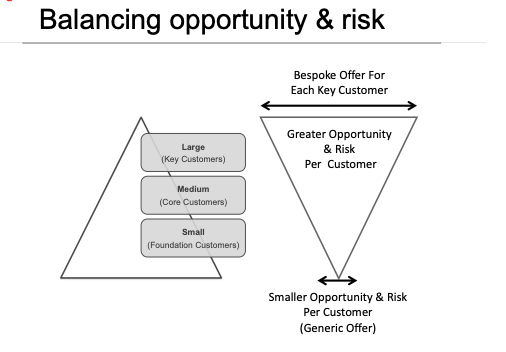

"The aim," David continued, drawing two opposing triangles on his paper, "is to balance opportunity and risk. At the top, a small handful of customers represent the 'Large' or 'Key Customers'.

These are where the greatest opportunity lies, but also the greatest risk and the highest cost to serve. For these, you create a bespoke offer. These are tailored solutions, dedicated support the customer.

Conversely, at the bottom, you have 'Small' or 'Foundation Customers'. These represent smaller opportunity and risk per customer, and for them, a more generic offer is appropriate.

All of this this allows you to apply effort strategically."

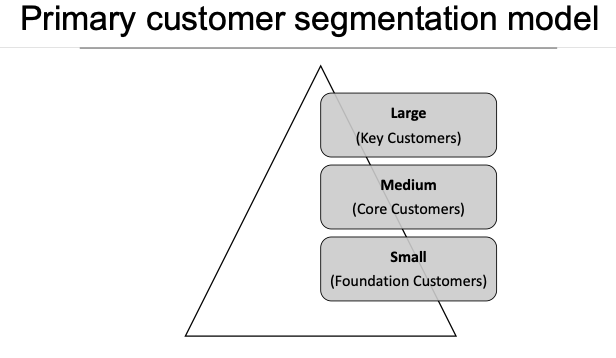

"Our primary segmentation model," David elaborated, pointing to a new sketch of a pyramid, "shuffles your entire customer portfolio into these buckets: 'Large' (your Key Customers), 'Medium' (your Core Customers), and 'Small' (your Foundation Customers).

We typically establish these primary cut-off levels based on annual sales volume. This is a straightforward, objective metric to begin with."

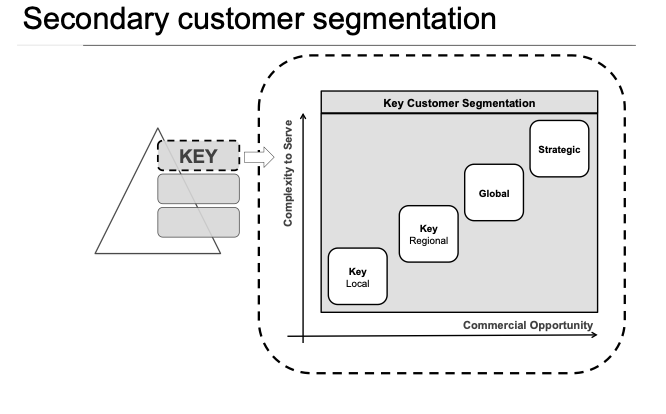

"Once you've done this primary sort, you'll be left with perhaps 50 to 75 potential key accounts," David explained, drawing a line from the 'KEY' section of the pyramid to a new, more complex matrix.

"This is where the secondary segmentation comes in. We then segment these key accounts further based on their nature.

Are they 'Key Local' i.e. important within a single geographic area? 'Key Regional' i.e. spanning two or more countries?

'Global' i.e. active across multiple regions?

Or, most importantly, 'Strategic' i.e. those taking products across multiple product streams, representing very high opportunity and deeply integrated partnerships. The real secret, Alan,"

David leaned forward, his voice dropping slightly, "is to keep it simple. Don't overcomplicate it."

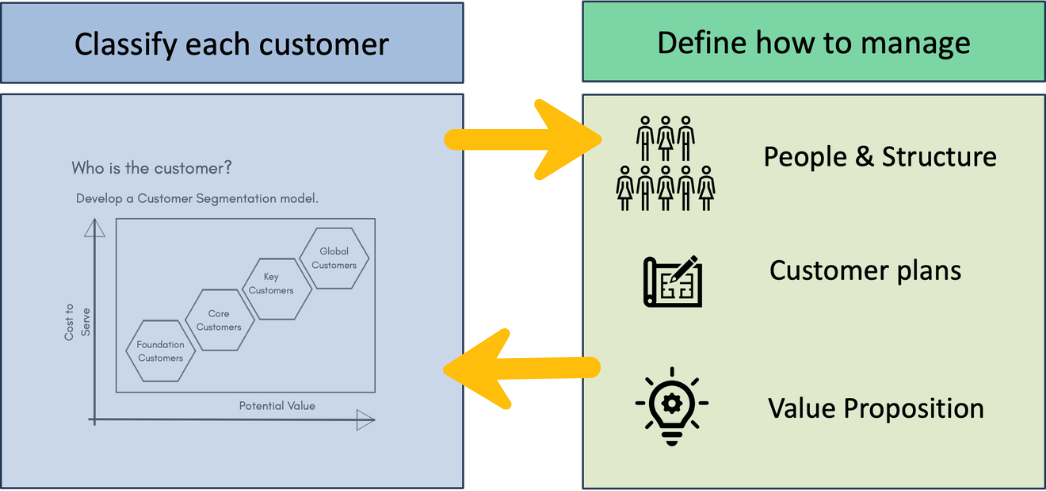

"Ultimately," David concluded, drawing two large interconnected circles, "you 'classify each customer'

You 'anoint' them, if you will, to decide precisely how much effort to apply. The greater the opportunity, the more effort you invest. Conversely, you consciously back off when there is less opportunity.

This then feeds into how you 'define how to manage' these segments: your People & Structure, your Customer Plans, and your Value Proposition will all align with the segmentation."

David paused, allowing the weight of his words to settle. "This is a classic situation for many organizations, Alan. They fail to identify who their true customers are, and as a result, they overinvest in lower-opportunity prospects while simultaneously underinvesting in their largest, most strategic, and key customers.

Concluding thoughts, according to David.

A value-based business, Alan, starts by truly understanding its customers and then developing and selling a value proposition that perfectly suits those customers' needs, all while ensuring profitability for the supplier."

"Get this wrong," David stated, his voice firm, "and the keystone of your business is missing. It's a critical step."

Do you need a segmentation guide?

Building a customer segmentation model and applying it to your business is critical.

It is also incredible difficult.

As the saying goes:

It is difficult to read the label when you are inside the jar.

Anon

This is the challenge with segmentation.

Firstly, developing a model that is right for your business, selecting and weighting the criteria you will adopt AND defining the scale that you will score against takes TIME.

Secondly, taking your customers through this model objectively and without bias benefits hugely from external facilitation.

- No emotion.

- No preconceived ideas.

- No personal agendas.

In short, you need an expert customer management expert that has done this before.

This is a core skill of Value-Matters.

We can help. E-mail if you would like to discuss your sales growth challenges.

When you are ready, there are a few ways I can help.

1. DOWNLOAD THE RETHINKING KAM ARTICLE:

If you want to find out more about Value-Based KAM and how it can become a significant competitive advantage to your business, click below and receive a copy of my latest article:

Rethinking Key Account Management: The 4 blocks to ignite KAM as your strategic competitive advantage.

If you would like a copy, please follow the link below

Click here for the Rethinking Key Account Management Article.

2. GET IN TOUCH TO DISCUSS COACHING OR TRAINING

Click on the link below, and we can start a discussion about your business needs and how a value-based approach might help you grow your sales.

I offer two streams of coaching:

- Key Account Management

- Offer Development & Innovation

I'd be pleased to have an initial conversation with you!

Click here to access the Value-Matters Coaching Options.

3. FOLLOW ME ON LINKED IN OR REQUEST TO CONNECT!

Responses